Where Business Dreams Take Flight

VAT Consultancy in Dubai, UAE

Your Trusted Partner for Seamless Business Setup in the UAE

VAT Consultancy Services in Dubai, UAE

At Startiffyzone FZE, we offer comprehensive VAT consultancy services to businesses in Dubai, UAE. Our team of experienced professionals is dedicated to helping you navigate the complexities of VAT regulations, ensuring your business remains compliant and efficient. We provide tailored solutions that include VAT registration, return filing, advisory, and audit support. Our experts stay up-to-date with the latest VAT laws and regulations, offering you accurate and timely advice.

We pride ourselves on delivering high-quality services that are characterized by meticulous attention to detail, professionalism, and transparency. Our goal is to simplify VAT processes, minimize your tax liabilities, and ensure seamless compliance. With Startiffyzone FZE, you can focus on your core business activities while we handle your VAT needs. Trust us to be your reliable partner for all your VAT consultancy requirements in Dubai, UAE.

Procedure for VAT Consultancy in Dubai

1

VAT in Dubai Is Levied at a Rate of 5%

2

Certain Services Have 0% VAT

3

Certain Services Are Exempt From VAT

4

You Can Get Some of Your VAT Paid Back

5

You Need to Register

for VAT

6

VAT Applies to Businesses With Income of AED 375,000 Annually

7

You Can Pay

Online

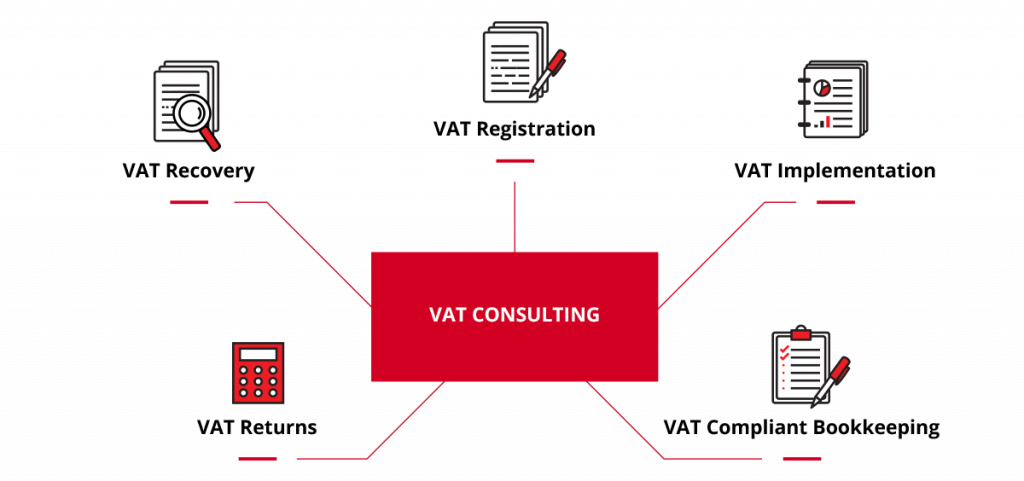

Here are some of the key VAT Services in Dubai

VAT Registration

Businesses that meet the VAT registration threshold are required to register for VAT with the Federal Tax Authority (FTA). We offer assistance with online registration services, including registering on the official FTA website.

VAT Return Filing

Registered businesses must file regular VAT returns with the FTA, reporting both VAT collected and paid. There are specific deadlines for VAT return submissions, and our team of experts ensures your filings are completed on time.

VAT Consultation

We assist businesses in understanding VAT regulations, preparing for VAT compliance, and managing complex VAT issues. Our expert team provides tailored solutions to ensure seamless and efficient VAT management.

VAT Compliance Services

We assist businesses in ensuring VAT compliance for their transactions, maintaining accurate records, and navigating VAT audits. Additionally, we offer comprehensive training to keep your team updated on the latest VAT regulations.

VAT Auditing

The FTA conducts VAT audits to ensure compliance. Businesses might require VAT auditing services to help them prepare for or manage these audits, ensuring adherence to regulatory standards and minimizing financial risks.